A family of four will not receive any rebate if their AGI exceeds $218,000.A couple without children will not receive any rebate if their AGI exceeds $198,000 and.An individual without children will not receive any rebate if their AGI exceeds $99,000.Your tax rebate amount will be reduced by $5 for each $100 your AGI exceeds the above thresholds.If you have children, you will receive an additional $500 per child.

#IRS GOV TRACK MY STIMULUS FULL#

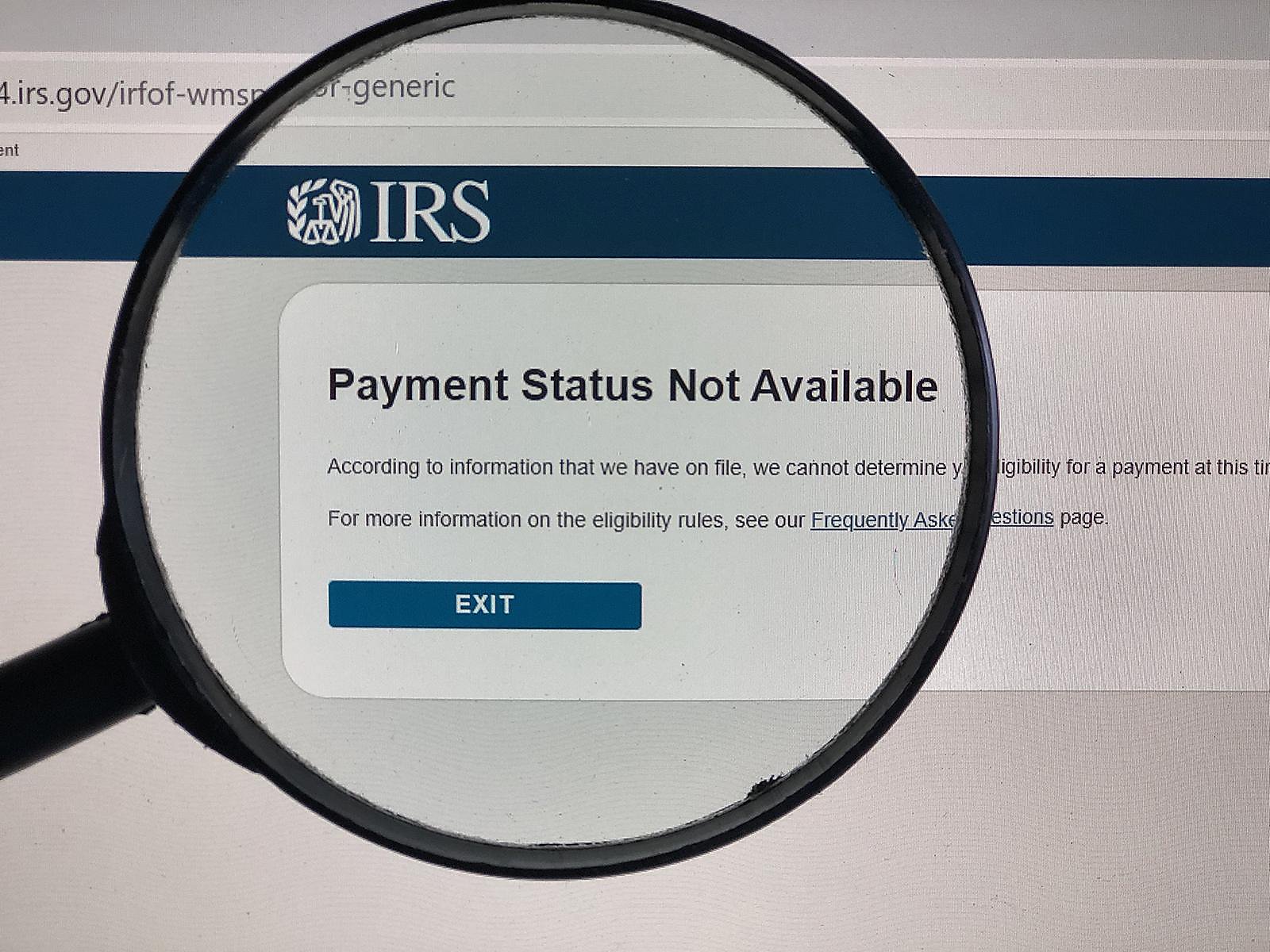

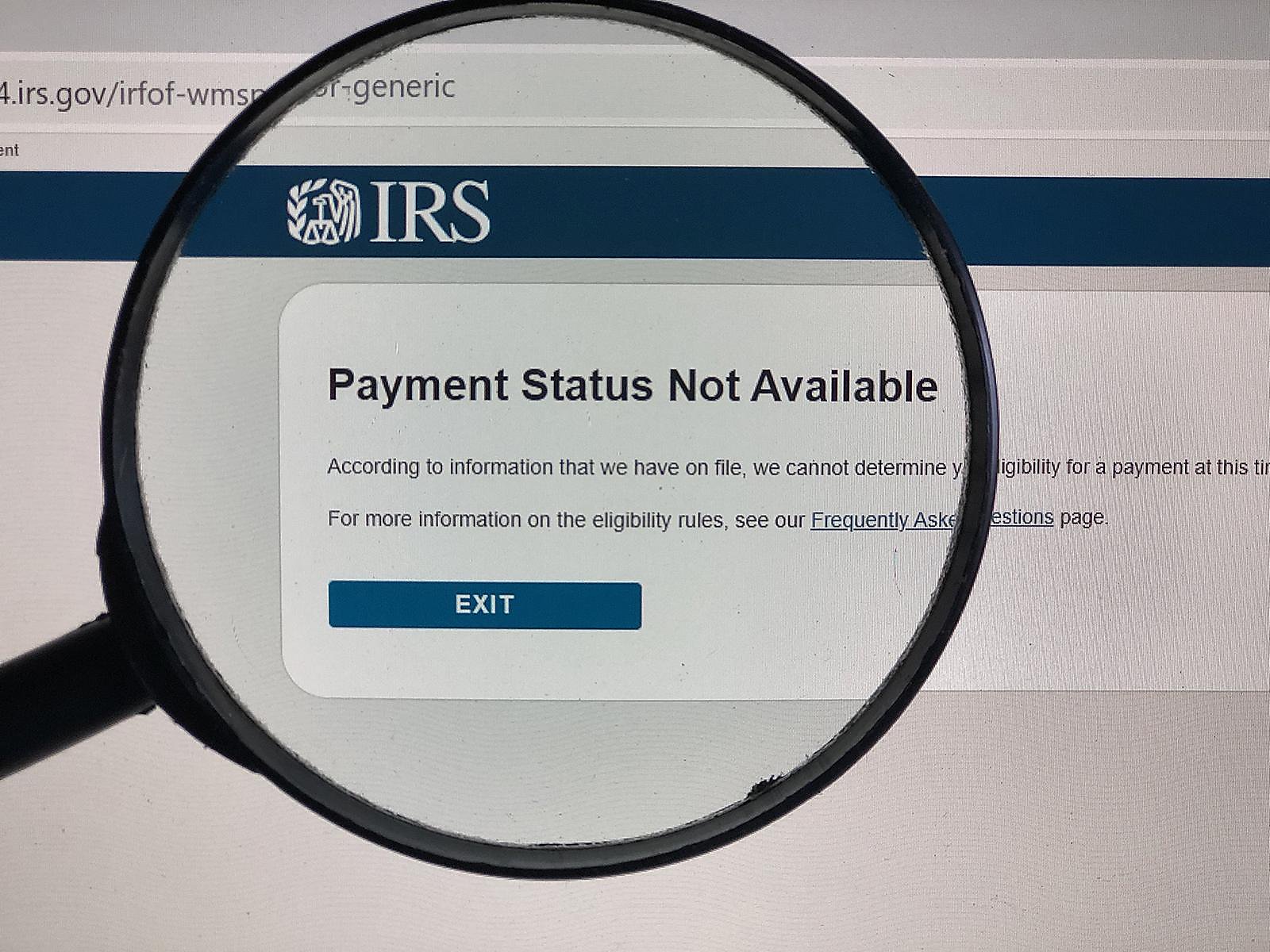

The full credit amount ($1,200 individuals, $2,400 couples, $500 for children) is available for individuals with AGI at or below $75,000 ($112,500 for heads of household), and couples with AGI at or below $150,000. How much money will those eligible receive? An adopted child can use an Adoption Tax Identification Number to be eligible. Spouses of military members are eligible without an SSN. This means workers, those receiving welfare benefits, Social Security beneficiaries, and others are all eligible. Any person that has a valid Social Security number (SSN), is not considered as a dependent of someone else, and whose adjusted gross income (AGI) does not exceed certain thresholds (see below), is eligible to receive the credit. Who is eligible to receive a rebate check? Additional information can be found below or here. Treasury will use information from Form SSA-1099 or Form RRB-1099 and deliver the refund as they normally get their Social Security payments. Seniors on Social Security who do not file taxes will NOT have to file a return. Most people will receive the refund stimulus as a direct deposit. That means for those without children, an individual will not receive any rebate if their income exceeds $99,000 and the same is true for couples with more than $198,000 of income. Your tax rebate amount will be reduced by $5 for each $100 your income exceeds the above income limits. If you have children, you will receive an additional $500 per child.

The full credit amount ($1,200 individuals, $2,400 couples, $500 for children) is available for individuals with income at or below $75,000 ($112,500 for heads of household), and couples with income at or below $150,000.The CARES Act provides financial support through a one-time check for American workers to help them as our country continues its work to defeat the novel coronavirus.

0 kommentar(er)

0 kommentar(er)